A Merchant Cash Advance is a type of funding available to business owners in need of immediate access to working capital. Rather than a traditional loan, a Merchant Cash Advance is structured as a lump sum payment to a business in exchange for an agreed-upon percentage of future credit card, debit card or cash sales.

We Make Alternative Investing Simple And Transparent

Keep Your Capital Working For You

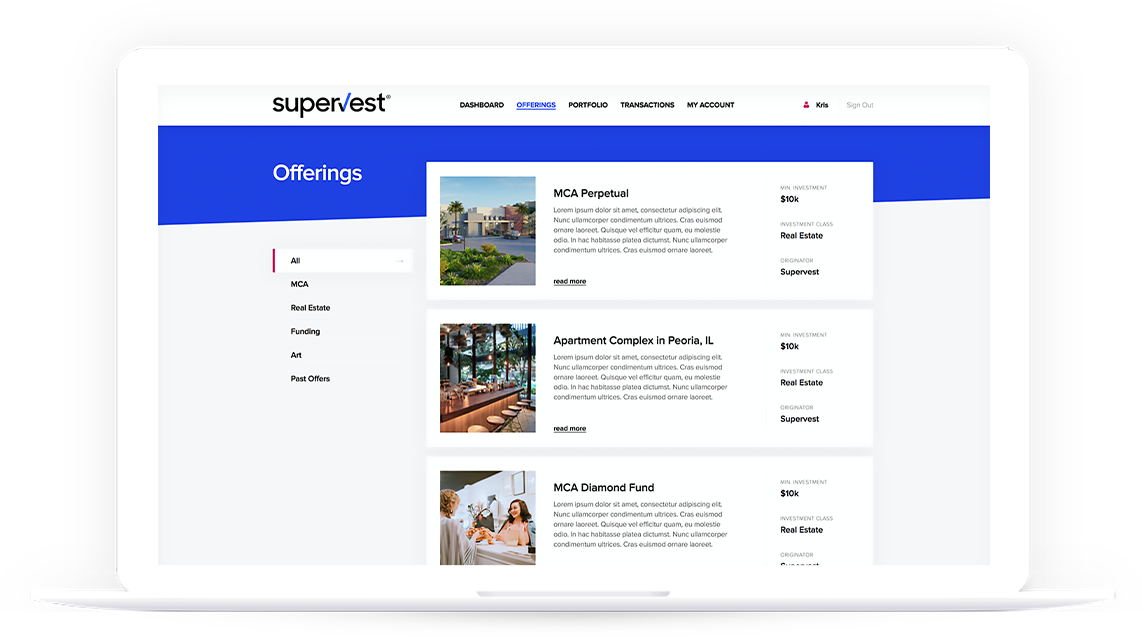

Find New Investments

With Ease

Discover opportunities in one central marketplace.

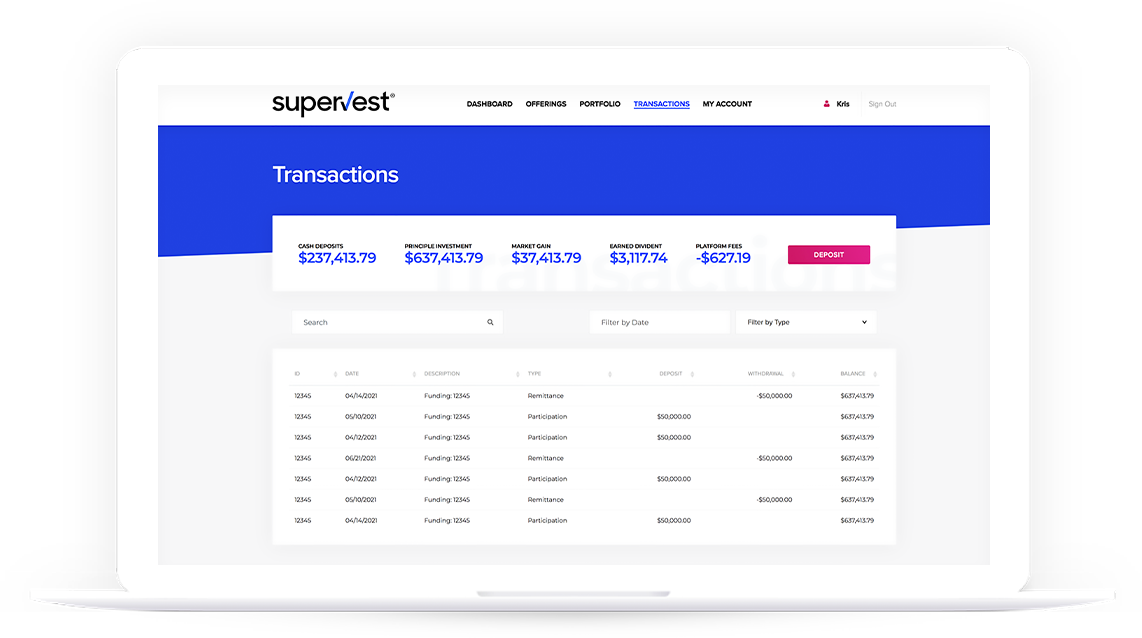

Centralize Your Portfolio

With Ease

Always know how your investment are performing.

Frequently Asked Questions

You Asked, We Answered.

-

What is a Merchant Cash Advance?

-

-

Why invest in Merchant Cash Advances?

-

As an investment, Merchant Cash Advances offer a variety of benefits to investors. Due to the nature of Merchant Cash Advances, Investors typically see a higher return on average compared to traditional loans.. Due to a shorter term (ranging from 3 to 14 months) investor capital is returned much faster and regularly. Correlation to traditional public equity and credit markets is typically low.

-

What is required for a business to qualify to receive MCA dollars on the supervest platform?

-

Merchant cash advances are acquired by applying from a lender. Financial statements are then examined by underwriters in order to verify the applicants current financial circumstance. Once this information has been verified, lenders determine a financial offer for the applicant. While applications are typically more relaxed than traditional loans, the application process still provides a thorough inspection to verify the business owner is able to repay the loan.

-

How are Merchant Cash Advances Different from loans?

-

Why are Interest rates so much higher on Merchant Cash Advances?

-

Due to the speed of the Merchant Cash Advance approval and funding process, Lenders typically apply a higher interest rate to balance their risk vs. potential return. Additionally, lenders are purchasing future receivables and are not secured against any hard underlying fixed assets.

-

What are the default rates of a Merchant Cash Advance?

-

Historically we have seen default rates between 8.5% to 10.5% on the Supervest platform.

-

How is my investment used by a business owner securing a Merchant Cash Advance?

-

Use of a Merchant Cash Advance is decided upon by the business owner. Typically a Merchant Cash Advance is used to purchase inventory, acquire new equipment, or expand their business. In order to secure the lenders investment, Merchant Cash Advances are not typically available to business owners looking to complete payroll, pay rent, or pay debts.

-

What return can I expect to see on a Merchant Cash Advance investment opportunity?

-

Supervest users have reported returns of 15% to 25%, each investors return may vary based on their individual preset investment deal criteria. Please keep in mind that past returns do not dictate future performance.

-

Do I have to wait for the investment to be fully funded before they start earning interest?

-

Yes, with respect to MCA deals, an investor will not begin to see remittances (interest) until they have fully funded their portion of the deal participation.