Listen to this article 3 min

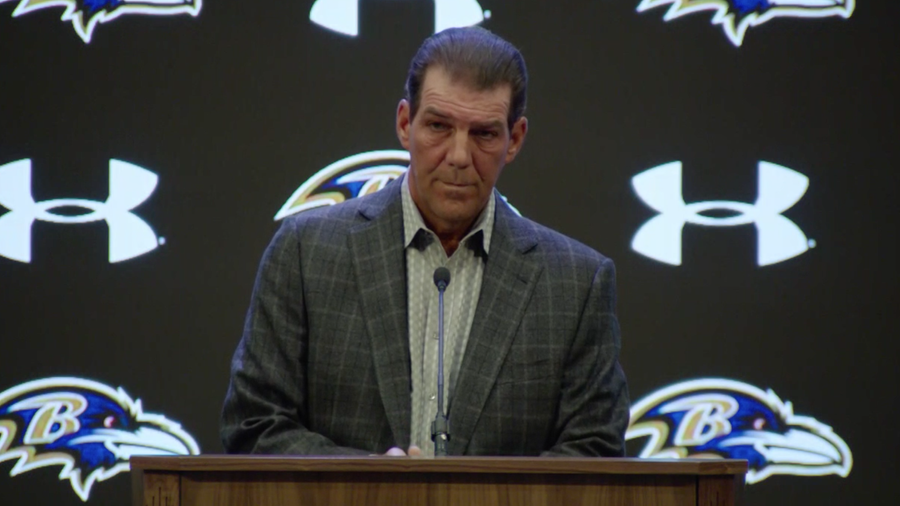

The owner of the Baltimore Ravens is creating an $100 million fund to help Baltimore replicate the rapid technology growth of cities like Boston or Silicon Valley.

The Stephen and Renee Bisciotti Foundation launched Blackbird Laboratories with a $100 million donation to offer grants to startups that need capital but are not ready to pursue traditional private funding. Blackbird, a nod to the Ravens mascot, hopes to build off the recent success of companies spinning out of the University of Maryland and Johns Hopkins University like Personal Genome Diagnostics and Haystack Oncology by funding more university-based startups and keeping them in the region.

Blackbird has been operating in stealth mode for several months before the public announcement on Tuesday and has already signed collaboration agreements with Hopkins and Maryland. Blackbird wants to fill the gap of funding between government grants and the private sector that often dooms promising companies before they can get their products to the market. Blackbird will offer $1 million to $2 million grants to startups so they can grow large enough to gain funding from private venture capital firms.

Government institutions like the National Institutes of Health fund a tremendous amount of basic research but can’t provide the capital to get a product to market. These early stage-research companies are often not quite ready to get investment from private equity and the venture capital markets since the technology still needs to go through human trials and other steps before an investor will show interest. Blackbird will step in at this early stage to keep the technology afloat and help a company attract private investment. Unlike many sources of capital available to startups, Blackbird will not take equity in a company.

Ryland Sumner, the head of Bisciotti's family office Point Field Partners, believes Baltimore is starting from a strong position with a large amount of federal research spending. The startup is part of the consortium led by the Greater Baltimore Committee to get Baltimore designated as a federal tech hub, a move that could attract millions in investment.

"There are places like Philadelphia that have come a long way in a short period of time," Sumner said. "Our hope is that some of the folks outside of this ecosystem will see this as an engine for creating companies and want to be a part of it."

The nonprofit lured Matt Tremblay, the former chief operating officer of the Scripps Research Institute to serve as CEO. At Scripps, Tremblay led a team of over 2,600 people to create biomedical technologies and new types of drugs. Scripps research has led to over 80 spinout companies. Tremblay wants the fund to focus on technology that has the potential to become the basis for large anchor companies that smaller startups can grow around.

"It's not that you need to have 100 companies in the next two years to have a successful ecosystem," Tremblay said. "What you need is to have is a handful of extremely strong companies with a long runway and a wide footprint."

The nonprofit will include several provisions to get those companies to stay in Baltimore. If a grantee licenses a patent to a larger pharmaceutical company, for example, most foundations require a repayment of their initial grant. Blackbird, in contrast, plans to waive that repayment requirement if the technology is licensed to a Baltimore company.

Blackbird is building off Bisciotti's prior efforts to support Baltimore entrepreneurship and university research. The work of Blackbird is similar to Bisciotti’s translational fund at Johns Hopkins University but on a much larger scale. The translation fund recipients receive between $25,000 and $100,000 to take technology out of the university and into the market. Sumner believes having a fund independent from a specific university will give Blackbird more flexibility than funds like the translational fund that are directly attached to one university. Eventually Sumner hopes to work with universities outside of Hopkins and Maryland if the project achieves success locally.

Readers should not expect to see Blackbird plastered on M&T Bank Stadium anytime soon, but the nonprofit has started to host out-of-town investors at Ravens games so they can learn about the city.

"We have the Ravens as an asset to draw people in for a fun afternoon," Tremblay said.