AEGIS CUSTODY RECEIVES APPROVAL TO FORM FULL-SERVICE TRUST COMPANY

Approval makes Aegis Custody the first bi-national digital asset custodian

South Dakota has a well-established history of leading the way in banking and trust, and its Division of Banking takes careful consideration of all applicants.”

SOUTH DAKOTA, UNITED STATES, December 9, 2020 /EINPresswire.com/ -- 1. Aegis Custody has received approval from the South Dakota Division of Banking to form a non-depository Public Trust Company, Aegis Trust Company.— Michael McCarty, President (Trust & Custody) of Aegis Custody

2. Once issued, the charter will allow Aegis Custody to scale up its asset custody and digitization solution in order to service asset owners and investors on a global scale.

3. Aegis Custody is building a digital global finance ecosystem aimed at supply chain accounts receivable asset owners and investors for asset digitization and fixed-income product investment.

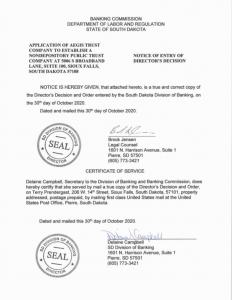

Aegis Custody, the end-to-end asset custody and digitization solution powering the digital transformation of traditional finance, today announced the approval of its trust charter application by the Director of the South Dakota Division of Banking.

The approval grants Aegis Custody permission to register and incorporate a Non-Depository Public Trust Company in South Dakota as Aegis Trust Company, open the necessary accounts and obtain proper insurance coverage in advance of the charter being issued and commencement of regulated activities.

“We were thrilled to receive the approval letter from the Director of the South Dakota Division of Banking,” said Michael McCarty, President (Trust & Custody) of Aegis Custody. “South Dakota has a well-established history of leading the way in banking and trust, and its Division of Banking takes careful consideration of all applicants. And while our charter has not yet been issued, the approval of our application is a crucial step and one we have achieved.”

Upon issuance of the charter, Aegis Custody will become the first bi-national digital asset custodian, with regulated fiduciary services in Hong Kong and the United States. For American investors, this means the ability to invest in Asian assets without their money leaving the U.S. jurisdiction.

At the foundation of Aegis Custody’s efforts to digitally transform traditional finance is its regulated asset custody and digitization solution. Any physical asset can be digitized, stored on blockchain, and then invested in. This includes anything from recurring cash flow assets to commodities and private debt to private and public business holdings and assets held in Trust. For investors, this means access to new digital asset markets for portfolio diversification. Digital assets are stored on Aegis Custody’s proprietary cold storage wallet solution, Aegis Pen, which offers institutional-grade security to asset holders operating on various public and private networks.

Aegis Custody is also building the first digital global supply chain finance ecosystem to connect accounts receivable asset owners with investors. The ecosystem includes a full-course factoring solution that allows asset owners to get working capital by creating digital assets from their outstanding invoices and listing them for investors. Investors, in turn, get access to short-term, fixed-income investment opportunities with high annualized returns.

Designed in accordance with regulatory oversight, Aegis Trust Company will operate under the same regulatory frameworks as all banks and trust companies. The company uses sound fiduciary best practices to build asset owner and investor confidence in the digital asset world.

“The addition of our U.S. Trust Charter positions us the leader in global asset custody and digitization,” added Mr. McCarty. “Having two regulated trust companies in leading financial markets demonstrates our commitment to a safe and transparent asset custody and digitization solution built on the legacy of trusted best practices and oversight, as well as our commitment to servicing investors and asset owners on a global scale.”

-- END --

About Aegis Custody

Founded in 2018, Aegis Custody is powering the digital transformation of traditional finance through its end-to-end asset custody and digitization solution. Operating under the same regulatory frameworks as all banks and trust companies, the company allows any physical asset to be digitized and invested in.

As part of its efforts to digitally transform traditional finance, Aegis Custody is building the first digital global supply chain finance ecosystem to create new liquidity opportunities for accounts receivable asset owners and fixed-income products for investors.

Aegis Custody utilizes regulated fiduciary Trust Companies in Hong Kong to hold all digital assets in segregated and transparent trust accounts. Approval to form a Non-Depository Public Trust Company has been granted by the South Dakota Division of Banking.

Headquartered in the U.S. and Taiwan, the company has offices in Hong Kong and South Dakota.

Tien Ma

REDHILL (for Aegis Custody)

tien@redhill.world